Market Update: America Housing Report June 2022

Markets across the nation appear to be cooling off as the effects of rising mortgage rates on buyer affordability begin to set, but housing remains in demand according to a recent real estate report by Redfin.

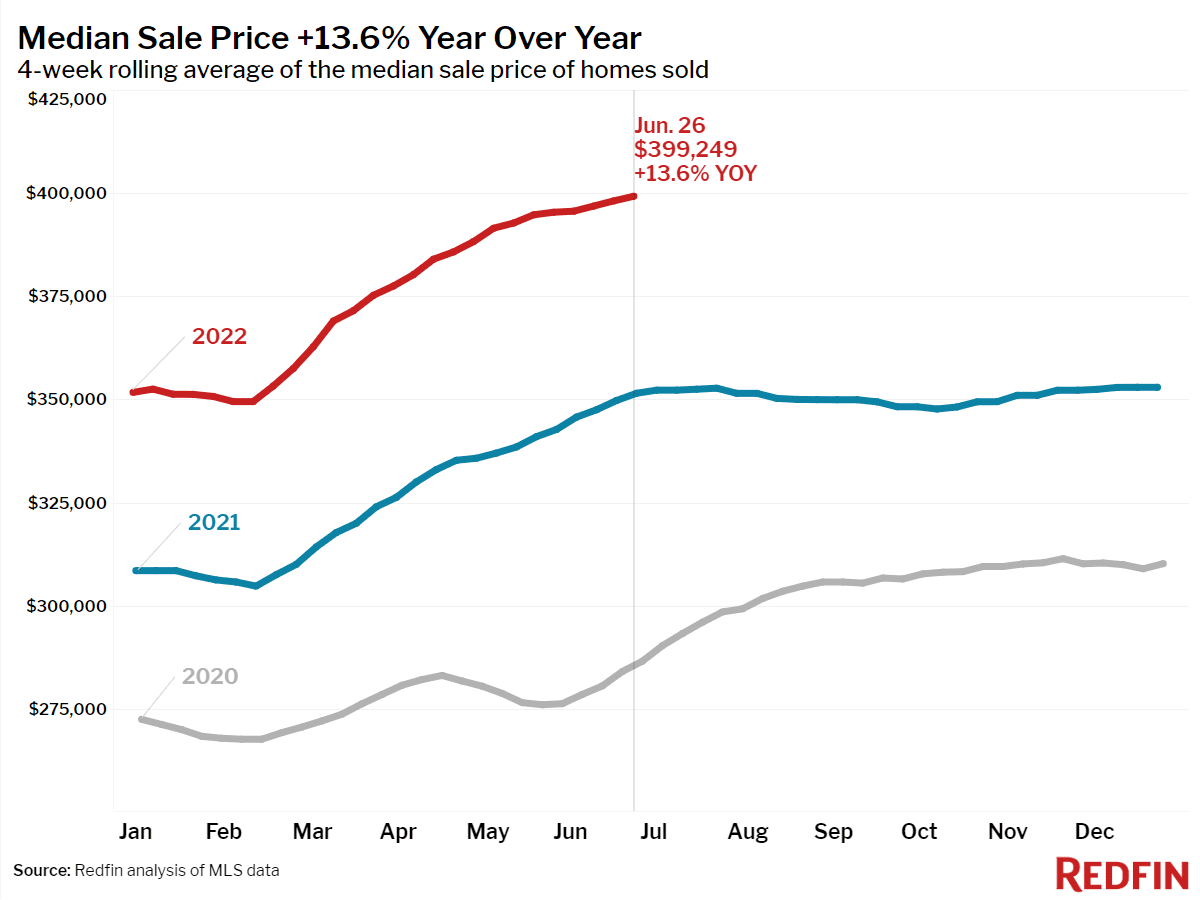

Looking at the report, the average monthly mortgage rate payments on the median home price have increased 45% compared to the same time last year, from an average of $1,694 a month to $2459. As a result of a decrease in buyer affordability, the average median home price has begun to decrease month-over-month. However, the median home price still increased 14% year-over-year to $399,249.

Redfin – Housing Market Update Asking Prices Come Down from All-Time High

These gradual declines in buyers searching for and procuring homes across the country do indicate a subtle shift in the real estate market, though this brief subsiding in sales does not support the possibility of a major decrease in homebuyers. As mentioned by Redfin economist Daryl Fairweather, there could be going forwards a trend in subtle declines of housing sales, though also a recurring increase of homebuyers to match, all of which coincides with monthly trends which might increase as quickly as the market decreases in sales and home-buying interest.

“Buyers coming back will provide support to the housing market, but between now and the end of year I think the power will continue to shift towards buyers, resulting in mild price declines from month to month.” Exlplains Daryl Fairweather.

SOURCE:

Housing Market Update: Asking Prices Decline – Redfin